For times, the world of blockchain and digital means was largely perceived as the sphere of retail investors and tech suckers, frequently met with dubitation by traditional fiscal institutions. Volatility, nonsupervisory nebulosity, and structure gaps kept institutional capital at bay. Still, a significant shift is underway. Moment, smart plutocrat moves are easily demonstrating a profound and growing commitment from institutions, unnaturally reshaping blockchain and digital asset portfolios and steering the entire assiduity towards unknown maturity.

This composition takes a deep dive into how and why leading fiscal institutions are embracing digital means, exploring their sophisticated investment strategies and the profound impact of their involvement on the evolving fiscal geography.

Why the Shift? Drivers of Institutional Digital Asset Adoption

The pivot by institutions from caution to active engagement is driven by a convergence of compelling factors.

Diversification & threat-Acclimated Returns

Traditional portfolios, frequently dominated by stocks and bonds, have seen increased correlation. Digital means, particularly Bitcoin and elect altcoins, have historically demonstrated low correlation to traditional requests, offering a important tool for portfolio diversification and potentially enhancing threat-acclimated returns. Studies show indeed modest crypto exposure can significantly ameliorate Sharpe rates.

Technological Innovation & Disruptive Implicit

Beyond academic trading, institutions fete the profound, long-term disruptive eventuality of blockchain technology. From streamlining force chains to enabling new fiscal savages in Decentralized Finance (DeFi), the underpinning invention is too significant to ignore.

Customer Demand

Sophisticated guests, including family services and high-net-worth individualities, are decreasingly demanding access to digital means, compelling wealth directors and asset directors to offer results.

Growing Structure

The development of institutional-grade crypto guardianship results by regulated realities (like Coinbase Custody, Anchorage Digital) has addressed critical security and compliance enterprises, removing a major hedge to entry.

Arising Regulatory Clarity

While still evolving, significant strides in nonsupervisory fabrics – similar as the blessing of spot Bitcoin ETFs in the US and the perpetration of MiCA in the European Union – have handed important-demanded legality and clear guidelines, making it safer for institutions to engage.

How Institutions Are Investing: Diverse Strategies and Vehicles

The entry of institutions is not a monolithic movement. They’re employing a range of institutional digital asset strategies acclimatized to their threat appetite, nonsupervisory conditions, and investment objects.

1. Regulated Investment Vehicles: The Preferred Gateway

Rather than direct spot effects, utmost institutions prefer circular exposure through regulated products that fit within their being compliance fabrics.

Exchange-Traded Products (ETPs / ETFs)

The launch and success of spot Bitcoin ETFs have been a game-changer, allowing flawless integration of Bitcoin into traditional portfolios. Expectation for Ethereum ETPs and diversified crypto indicator finances indicates a broadening appetite for accessible, regulated exposure.

Futures-Grounded Finances

Products like Bitcoin futures on CME give regulated avenues for hedging and enterprise.

Private Finances & Trusts

Specialized digital asset finances and trusts (e.g., Grayscale Bitcoin Trust) offer managed exposure, particularly prior to wider ETF vacuity.

Public Equities

Investing in intimately traded companies heavily involved in the blockchain ecosystem (e.g., crypto exchanges, booby-trapping companies, blockchain tech enterprises).

2. Real-World Asset (RWA) Tokenization: The Next Frontier

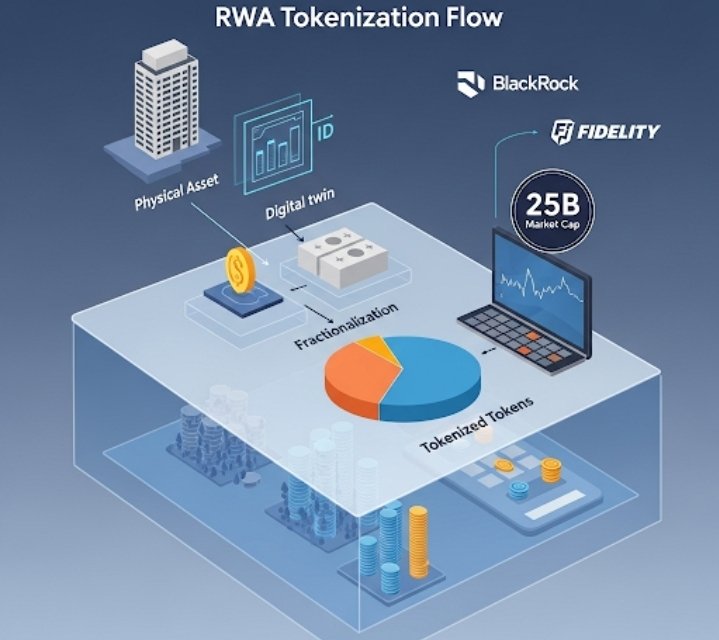

This is arguably the most significant area of institutional blockchain investment. RWA tokenization involves converting power rights of palpable and impalpable means (like real estate, bonds, coffers, private credit, fine art) into digital commemoratives on a blockchain.

Unleashing Liquidity

Tokenization transforms traditionally illiquid means into fractional, largely tradable units, standardizing access and perfecting request effectiveness. The RWA request surged past $25 billion in Q2 2025, with major fiscal players laboriously developing results.

Enhanced Effectiveness & Translucency

Blockchain brings briskly agreement times (from days to near-immediate) and inflexible power records, reducing functional costs and counterparty threat.

Institutional-Grade Aviators

Leading banks and asset directors are launching airman systems and indeed live products, feting RWA tokenization as public fiscal structure.

3. Venture Capital (VC) & Strategic Investments

Beyond direct asset allocation, institutions are canalizing capital into the underpinning invention.

Blockchain Startups

Investing in early-stage companies erecting pivotal blockchain structure, Subcaste 2 scaling results, DeFi protocols, and Web3 operations.

DeFi Engagement

While largely conservative, some institutions are exploring institutional DeFi platforms, exercising insulated, regulated pools for lending, borrowing, and yield generation, frequently involving stablecoins for effective capital operation.

4. Commercial Treasury Relinquishment

A growing number of public companies are adding Bitcoin or other digital means to their commercial balance wastes as a strategic reserve asset, driven by diversification and affectation barricade narratives.

The Transformative Impact of Institutional Involvement

The affluence of institutional plutocrat in crypto isn’t simply adding request capitalization; it’s unnaturally reshaping the entire ecosystem.

Request Maturity & Stability

Institutional participation brings deeper liquidity, which can help stabilize prices and reduce the extreme volatility historically associated with digital means. Their large trades, frequently grounded on expansive analysis, contribute to more effective price discovery.

Increased Legality & Mainstream Acceptance

When established fiscal titans validate digital means, it significantly boosts public confidence and accelerates mainstream relinquishment, reducing the smirch formerly attached to crypto.

Robust Structure Development

The strict demands of institutions for security, compliance, and scalability are driving rapid-fire invention and investment in advanced digital asset operation platforms, high brokerage services, and robust data analytics.

Accelerated Regulatory Evolution

Institutions are laboriously engaging with controllers, furnishing input, and championing for clearer, more harmonious fabrics, which in turn further attracts further mainstream players.

Navigating the Challenges for Institutional Adoption

Despite the instigation, institutions still face hurdles.

Lingering Regulatory Query

While perfecting, fractured regulations across authorities and the evolving bracket of colorful digital means still pose complications.

Custody and Security

Despite advancements, the unique security conditions of digital means (e.g., managing private keys, protection against cyber pitfalls) bear largely technical institutional crypto security results.

Valuation Complications

Directly valuing incipient digital means and protocols frequently requires new methodologies beyond traditional fiscal models.

Reputational Threat

Although dwindling, the perception of volatility and history dishonors can still pose a challenge for public-facing institutions.

The Road Ahead: Continued Institutionalization

The line is clear: the institutionalization of digital means is an impregnable force. As blockchain invention continues, coupled with the adding clarity in the nonsupervisory geography, digital means will come an decreasingly integral part of diversified investment portfolios encyclopedically. From tokenized coffers to sophisticated DeFi strategies for yield, institutions aren’t just sharing; they’re laboriously erecting the fiscal structure of hereafter. Their sapient “smart plutocrat moves” are paving the way for the coming period of global finance.