The allure of the forex market is undeniable. With its 24/5 accessibility, high liquidity, and potential for significant returns, it attracts countless traders worldwide. However, the very factors that make forex trading exciting – particularly its inherent volatility and the use of leverage – also make it inherently risky. For both seasoned traders and forex beginners, understanding and implementing robust risk management in forex is not just advisable; it’s absolutely essential. This comprehensive guide will delve into crucial strategies to protect your capital and lay the groundwork for sustainable forex trading success.

Without effective capital protection, even the most brilliant trading strategies can lead to substantial losses. Many new traders focus solely on maximizing profits, overlooking the critical importance of minimizing potential downsides. True mastery in currency markets isn’t just about winning trades; it’s about surviving inevitable losses and ensuring your trading capital remains intact to seize future opportunities.

Why Risk Management is the Cornerstone of Forex Trading

The forex market volatility is a double-edged sword. While it creates opportunities for profit from rapid price movements, it also exposes traders to swift and unexpected losses. Economic news, geopolitical events, central bank decisions, and even social media sentiment can trigger dramatic shifts in currency values in seconds. Without a disciplined approach to managing trading risks, a single adverse market move can wipe out an entire trading account.

Consider this: a series of winning trades can be undone by one poorly managed losing trade. This highlights why capital preservation must be your top priority. Effective risk management acts as your financial shield, safeguarding your funds against the unpredictable nature of the global currency exchange.

Core Principles for Effective Forex Risk Management

To truly master forex risk management, you must integrate several fundamental principles into every trade you make. These aren’t just suggestions; they are non-negotiable rules for long-term survival in the market.

1. Define Your Risk Tolerance

Before placing any trade, you must clearly define your risk tolerance in trading. This means understanding how much of your total trading capital you are willing to risk on a single trade, and how much you are prepared to lose overall.

Rule of Thumb: A common guideline for forex risk appetite is to risk no more than 1-2% of your total trading capital per trade. For example, if you have a $10,000 account, you should risk no more than $100-$200 on any single position. This small percentage ensures that a string of losing trades won’t decimate your account.

Emotional Resilience: Your risk tolerance should also align with your emotional capacity. If risking 2% makes you overly anxious, reduce it to 1% or even 0.5%. Trading under emotional stress leads to poor decisions.

2. Master Position Sizing

Once you know your risk per trade, the next critical step is forex position sizing. This involves calculating the appropriate lot size for your trade based on your stop-loss distance and your defined risk tolerance.

Calculation:

- Determine your maximum dollar risk per trade (e.g., 1% of $10,000 = $100).

- Determine your stop-loss distance in pips.

- Use a position size calculator (many online tools are available) or a manual formula to find the correct lot size (standard, mini, or micro lots) that ensures your maximum loss doesn’t exceed your defined risk if the stop-loss is hit.

Why it Matters: Correct calculate lot size forex ensures that even if your stop-loss is triggered, the actual dollar amount lost is within your acceptable limits. This prevents overexposure and catastrophic losses.

3. Implement Stop-Loss Orders Religiously

A stop-loss order in forex is an instruction to your broker to automatically close your trade if the price moves against you to a predetermined level. It is your most vital tool for limiting losses in trading.

Purpose: A stop-loss prevents unlimited losses. Without it, a sudden market crash or surge could liquidate your entire account.

Placement: Place your stop-loss based on technical analysis (e.g., below a support level, above a resistance level), not just a random number.

Never Move Against It: Once placed, resist the urge to move your stop-loss further away from your entry point, hoping the market will turn around. This is a common and costly mistake.

4. Utilize Take-Profit Orders

While stop-losses protect against downside, take-profit orders in forex help you lock in gains. This is an instruction to your broker to automatically close your trade when the price reaches a predetermined profit target.

Purpose: It ensures you secure profits before a market reversal. Many traders see their profits disappear because they don’t exit at their target.

Placement: Place your take-profit based on technical analysis (e.g., at a resistance level, a Fibonacci extension, or a previous high/low).

5. Understand Your Risk-Reward Ratio

The risk-reward ratio in forex compares the potential profit of a trade to its potential loss. For example, a 1:2 risk-reward ratio means you are aiming to make twice as much profit as you are risking to lose.

Importance: Aim for trades with a positive risk-reward ratio (e.g., 1:1.5, 1:2, or higher). Even if you only win 50% of your trades, a consistent positive risk-reward ratio can lead to profitable trading over time.

Example: If you risk $100 (1R) to make $200 (2R), your ratio is 1:2. If you win 50% of your trades, you’ll still be profitable.

Advanced Risk Management Strategies for Forex Traders

Once you’ve mastered the core principles, consider these more advanced strategies to further enhance your capital protection:

Diversification in Forex: Don’t put all your capital into a single currency pair or strategy. Forex diversification involves trading multiple, uncorrelated currency pairs or employing different strategies to spread risk. If one trade goes bad, it won’t sink your entire portfolio.

Trailing Stops: A trailing stop loss in forex is a dynamic stop-loss order that automatically adjusts as the price moves in your favor. This helps to lock in profits while still allowing the trade to run if the trend continues. It’s a great tool for maximizing gains in trending markets.

Currency Correlation: Understand currency correlation in forex. Some pairs move in the same direction (positive correlation, e.g., EUR/USD and GBP/USD), while others move in opposite directions (negative correlation, e.g., EUR/USD and USD/CHF). Trading highly correlated pairs can lead to overexposure if you’re not careful. Avoid opening multiple trades that essentially risk capital on the same underlying market sentiment.

Hedging (for experienced traders): This involves opening opposing positions to offset potential losses. While it can reduce risk, it’s complex and can also limit profits or incur additional costs. It’s generally not recommended for beginners.

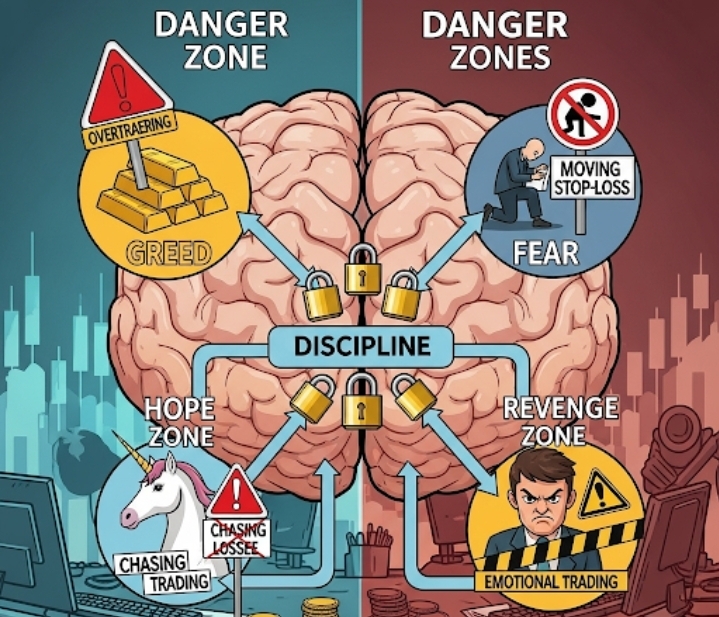

The Psychology of Risk Management: Discipline is Key

Even with the best strategies, trading psychology and risk are deeply intertwined. Emotions like fear, greed, hope, and revenge can sabotage even the most well-planned risk management strategy.

Discipline: Stick to your trading plan and risk rules, even when emotions run high. This is where discipline in forex truly shines.

Avoid Overtrading: Don’t trade just for the sake of it. Only take trades that meet your predefined criteria.

Don’t Chase Losses: If a trade hits your stop-loss, accept the loss and move on. Trying to immediately recover losses often leads to larger, more reckless trades.

Regular Breaks: Step away from the charts to clear your mind and avoid burnout.

Practical Tips for Implementing Risk Management

Use a Forex Demo Account: Practice all your risk management techniques on a forex demo account before risking real money. Get comfortable with setting stop-losses, calculating position sizes, and sticking to your plan.

Keep a Detailed Trading Journal: Document every trade, including your entry/exit points, stop-loss/take-profit levels, reasons for the trade, and your emotional state. Analyzing your trading journal benefits can reveal patterns in your decision-making and help you refine your risk management.

Never Over-Leverage: While leverage can be tempting, it’s also the fastest way to lose money. Start with low leverage and only increase it as you gain experience and confidence in your risk management abilities. Avoid overleveraging at all costs.

Continuous Education: The market evolves, and so should your knowledge. Continuously learn about new strategies, market dynamics, and risk management techniques.

Conclusion: Your Path to Sustainable Forex Trading

Mastering risk management in forex is not a one-time task but an ongoing process that is fundamental to your long-term success in the currency markets. By diligently applying principles like defining your risk tolerance, precise position sizing, strategic use of stop-loss and take-profit orders, and understanding risk-reward, you build a resilient foundation. Coupled with advanced strategies and unwavering psychological discipline, you can effectively protect your capital and navigate the volatile world of forex with greater confidence. Remember, the goal isn’t to avoid losses entirely, but to manage them effectively so that your winning trades can lead to consistent, sustainable forex trading growth over time.