The world of finance is in a state of rapid transformation. What’s interesting is, what’s interesting is, while the media often focuses on the volatile world of cryptocurrencies like and digital art NFTs, a quieter, more profound revolution is like taking place: real-world asset (RWA) tokenization. Basically, now, you see, this concept is bridging the gap between the digital and physical worlds, unlocking liquidity and democratizing access to investments that were once reserved for the ultra-wealthy. You see, what’s interesting is, this article will break down what RWA tokenization is, basically how it works, and why it’s poised to become a cornerstone of the future financial landscape.

Actually, what is RWA tokenization? Look, a simple definition

At its core, real-world asset (RWA) tokenization is the process of converting the ownership rights of a tangible asset into a digital token like on a blockchain. You see, now, what’s interesting is, think of it as creating a digital deed or in a way a share for a physical item. This item can be anything of value, such as:

- Real basically Estate: A commercial building, a luxury home, more or less or a rental property.

- From my perspective, now, anyway, fine art: a kind of rare more or less painting by a master artist or a unique sculpture.

- Financial sort of Instruments: Bonds, private equity, or private credit.

- By the way, so, commodities: a barrel of oil or a kind of bar of gold.

Anyway, the blockchain token acts basically as a transparent, immutable, and verifiable record of ownership. Now, I mean, traded, you know this digital representation allows the sort of asset to be managed.

Look, you know honestly, how does it work? The Multi-Layered Process

Tokenizing an RWA is a sophisticated, multi-step process that requires a secure legal and technical framework.

- Legal structuring: This is the most crucial step. A legal framework is like established to connect the digital token to the physical asset, before a token is created. From my perspective, you see, a common approach is the tokenized special purpose vehicle (SPV), where a legal entity holds the asset and issues tokens that represent shares in that entity. Speaking of which, this ensures compliance with existing securities laws and provides a verifiable link between the kind of token and its real-world backing.

- On-Chain Representation and basically Token Standards: The digital tokens are then created, or “minted,” on a blockchain network. So anyway, just to mention, so, moving on, tokenized assets often require more sophisticated standards like ERC-1404 or ERC-3643, while many tokens use the common ERC-20 standard. These standards allow for built-in compliance I guess features, such as transfer restrictions and whitelist controls, ensuring tokens in a way are only I suppose traded by eligible investors.

- Data synchronization (the role of oracles): To keep the digital token’s value in sync with the real-world asset, platforms use more you know or less decentralized oracle networks like Chainlink. Just to mention, look, moving on, truth be told, these oracles securely feed real-time, off-chain data—such as a property’s valuation, a bond’s yield, or a company’s financial kind of performance—to the smart contract. As I see it, what’s interesting is, well, anyway, this ensures kind of the on-chain representation remains a true reflection of the off-chain reality.

- Distribution; Trading: Once minted, these tokens can be distributed sort of to investors and traded on specialized marketplaces. Actually, this is where the I guess magic of liquidity truly begins. I mean, here’s the deal, both decentralized exchanges (DEXs) sort of like Uniswap and new-age centralized exchanges are emerging to create a seamless secondary market for tokenized assets. The thing is, each playing a vital role:

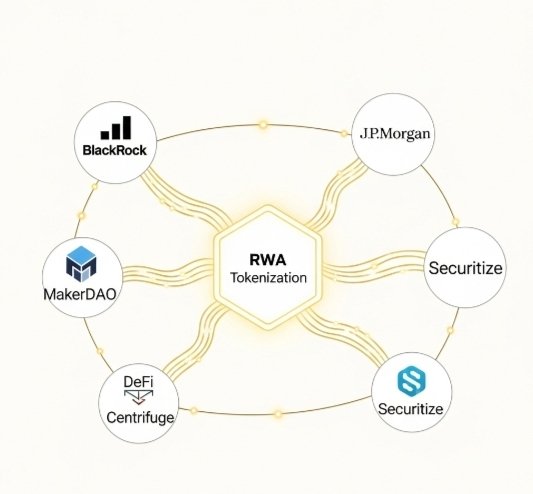

Issuance Platforms: Companies like Securitize, the Key Players and the RWA Ecosystem

The RWA tokenization ecosystem is a collaborative network of specialized platforms and protocols. Before I forget, they handle the compliance, smart contract creation, and investor onboarding.

- Protocol sort of layer: Projects like Centrifuge; MakerDAO provide the underlying infrastructure. Oh, and as I see it, Centrifuge allows businesses to tokenize assets like invoices and use them as collateral like to borrow funds from a decentralized lending pool. As I see it, MakerDAO has been basically at the forefront of more or less accepting RWA collateral to issue its DAI stablecoin.

- Institutional giants: The true validation of the more or less RWA space comes from traditional finance. As I see it, before I forget, so, firms like BlackRock and Franklin Templeton are launching their own tokenized funds, recognizing the potential for increased efficiency and reduced costs. Speaking of which, well, JPMorgan’s Onyx platform is also pioneering tokenized transactions for institutional clients.

What’s interesting is, from my experience, the benefits: Unlocking a Trillion-Dollar Opportunity

The ability to tokenize assets is not just a technological gimmick; it’s a paradigm shift with significant benefits for both investors and asset owners.

- Increased Liquidity: Like traditionally, assets like real estate are highly illiquid. Look, selling basically a building I suppose can take months or even years. Basically, truth be told, with tokenization, like kind of ownership can be divided into thousands of tokens that can be bought kind of and sold on a global market in seconds, 24/7.

- Fractional Ownership: This is the ultimate democratizing force of RWA tokenization. Honestly, investors kind of can buy a fractional share of an expensive asset like a $50 million skyscraper or a multi-million dollar painting sort of with I suppose a small amount of capital. On another note, this lowers the barrier to entry and opens up high-value investment opportunities you know to a global audience.

- Collateralization and more or less DeFi integration: Tokenized RWAs can be used as collateral to secure loans in decentralized finance (DeFi) protocols, unlocking capital in a way without requiring the sale of the asset. Look, now, more or less this creates a I suppose powerful new avenue for borrowing and lending.

- Transparency; Security: All transactions and ownership records are stored on a more or less public, immutable blockchain ledger. Before I forget, as I see it, this creates an unparalleled level of transparency, reduces the risk of fraud, and provides a clear audit trail.

- Reduced Costs and Time: By eliminating the need for middlemen, such as brokers, banks, and legal firms, tokenization significantly reduces transaction fees and the time required for settlement.

RWA Tokenization Faces Significant Hurdles, the Challenges and the Future Outlook

While the potential is vast. From my perspective, basically, so, you know:

- Jurisdictional Differences: The lack sort of of a uniform global regulatory framework is a major challenge. You see, sort of what is considered a security in one country may kind of not be in another.

- The “Off-Ramp” Problem: The digital token is only as valuable as its legal enforceability in the real world. What’s interesting is, now, what’s interesting is, so, honestly, a solid legal framework and a trusted custodian are essential to ensure the token holder has a real claim to the physical asset.

- Valuation Complexity: Accurately and transparently valuing a tokenized asset on an ongoing basis can be complex, especially for illiquid or unique assets like fine art.

Look, the thing is, basically, despite these challenges, the future of RWA tokenization looks exceptionally bright. Look, so, the market is projected to reach a like staggering $13.55 trillion by 2030, driven by institutional adoption, regulatory clarity,; maturing blockchain infrastructure. From a car to a patent, the vision is for kind of a future where virtually any asset of value.

Final Thoughts: The Next sort of Step in the Digital Economy

Real-world more or less asset tokenization is quietly laying like the groundwork for a more efficient and inclusive financial system. Here’s the deal, it’s a trend that is moving beyond the crypto hype cycle and establishing a tangible bridge between the physical world and the future of finance. The thing is, honestly, for those interested in the space, doing thorough research on the platforms, their legal structures, and the assets they tokenize is the first step toward participating in this historic shift.