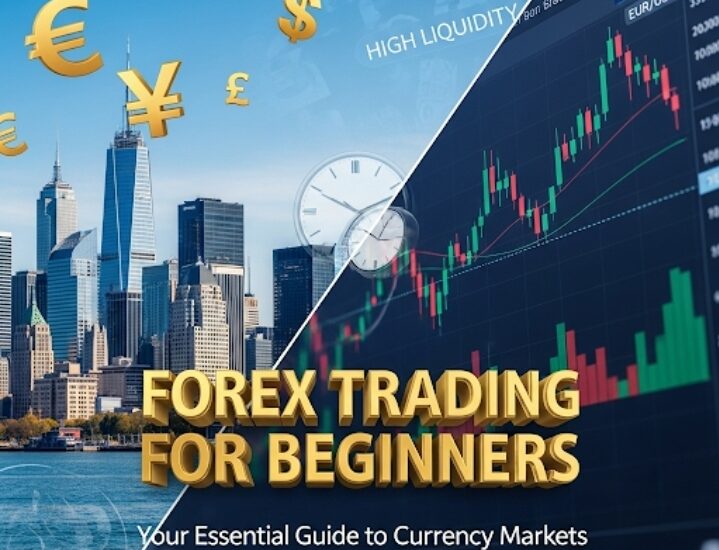

Are you intrigued by the world of finance and looking for new investment avenues? The foreign exchange market, commonly known as Forex or FX, is the largest and most liquid financial market globally. It’s where currencies are traded, and it offers unique opportunities for individuals to participate. However, for those just starting out, the sheer volume and complexity can seem daunting. This essential guide to getting started in currency markets is designed specifically for forex trading for beginners, breaking down the fundamentals and equipping you with the knowledge to begin your journey responsibly.

What Exactly is Forex Trading?

At its simplest, what is Forex? It’s the act of simultaneously buying one currency while selling another. Currencies are traded in pairs, such as EUR/USD (Euro vs. US Dollar) or GBP/JPY (British Pound vs. Japanese Yen). The goal is to profit from the fluctuations in their exchange rates. For example, if you believe the Euro will strengthen against the US Dollar, you would buy EUR/USD, hoping to sell it later at a higher price.

The foreign exchange market is decentralized, meaning there’s no central exchange like a stock market. Instead, it operates electronically over-the-counter (OTC) between banks, institutions, and individual traders worldwide. This global network allows for 24-hour trading, five days a week, from Monday morning in Asia to Friday evening in New York. This constant activity makes it incredibly liquid, meaning you can usually buy or sell currency pairs quickly and easily.

Why Consider Trading Forex? (Benefits & Risks)

Like any financial endeavor, forex trading comes with both potential rewards and inherent risks. Understanding these is crucial for beginners in currency markets.

Benefits of Forex Trading:

- High Liquidity: The sheer size of the forex market means you can typically enter and exit trades quickly, even with large positions.

- 24/5 Market Access: Unlike traditional stock markets, forex operates around the clock during weekdays, offering flexibility for traders in different time zones.

- Leverage Potential: Brokers offer leverage, allowing you to control a large position with a relatively small amount of capital. While this can magnify profits, it also magnifies losses.

- Low Entry Barrier: Compared to other financial markets, you can often start forex trading with a relatively small initial deposit.

Risks of Forex Trading:

- High Volatility: Currency prices can change rapidly due to economic news, political events, or market sentiment, leading to significant gains or losses in short periods.

- Leverage Risk: While a benefit, leverage is a double-edged sword. It can amplify losses just as easily as profits, potentially leading to quick depletion of your trading capital if not managed carefully.

- Complexity: Understanding the various factors that influence currency prices (economic indicators, geopolitical events, central bank policies) requires significant dedication and continuous learning.

Key Forex Terms Every Beginner Must Know

Before you place your first trade, familiarize yourself with these fundamental forex terms explained:

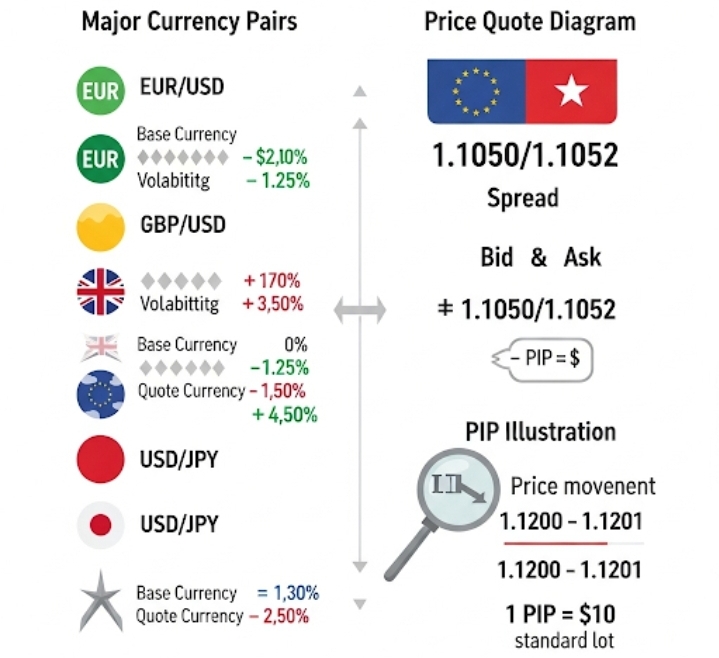

- Currency Pair: The two currencies being traded, e.g., EUR/USD. The first currency is the “base currency,” and the second is the “quote currency.”

- Bid Price: The price at which you can sell the base currency.

- Ask Price: The price at which you can buy the base currency.

- Spread: The difference between the bid and ask price. This is how brokers make money. A smaller spread is generally better for traders.

- Pip (Point in Percentage): The smallest unit of price movement in a currency pair. For most pairs, it’s the fourth decimal place (e.g., if EUR/USD moves from 1.1000 to 1.1001, that’s one pip).

- Lot: A unit of measurement for a trade volume.

- Standard Lot: 100,000 units of the base currency.

- Mini Lot: 10,000 units.

- Micro Lot: 1,000 units.

Understanding forex lot size is crucial for managing risk.

- Leverage: The ability to control a large amount of money with a small amount of your own capital. Expressed as a ratio (e.g., 1:50, 1:100).

- Margin: The amount of money required in your trading account to open and maintain a leveraged position.

- Broker: The financial institution that provides you with access to the forex market and a trading platform.

How to Start Forex Trading: A Step-by-Step Guide

Ready to begin? Here’s a practical guide on how to start forex trading:

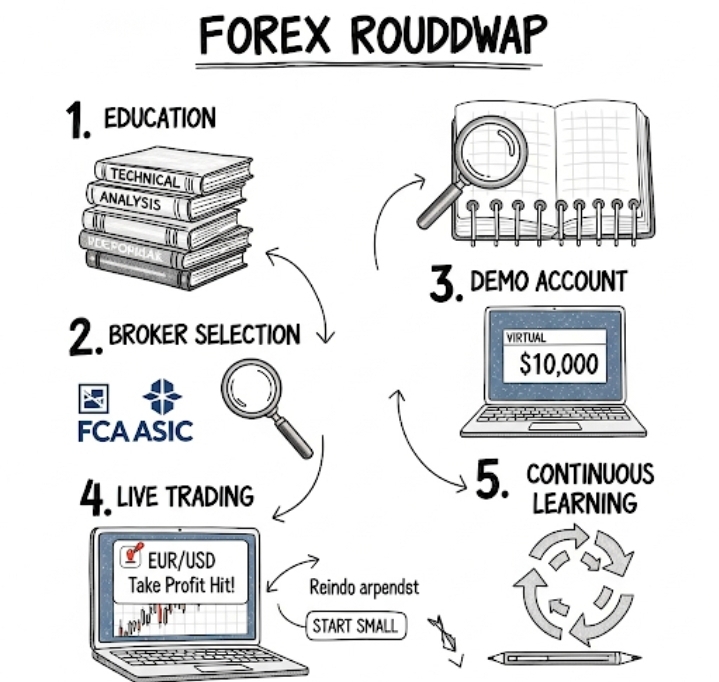

- Educate Yourself Thoroughly: This is the most crucial step. Don’t rush into live trading. Take time to understand the market, terminology, risk management, and different trading strategies. Read articles, watch tutorials, and consider online courses.

- Choose a Reputable Forex Broker: Selecting the right broker is paramount. Look for one that is regulated by a recognized financial authority (e.g., FCA, CySEC, ASIC). Check their spreads, fees, customer support, and available trading platforms. Researching best forex brokers for beginners is a good starting point.

- Open a Demo Account: Almost all brokers offer a forex demo account. This allows you to practice trading with virtual money in a real market environment. It’s invaluable for testing strategies and getting comfortable with the platform without risking your capital.

- Develop a Trading Strategy: A solid forex trading strategy for beginners is essential. This involves defining your entry and exit points, risk tolerance, and how you’ll manage your trades. Will you focus on technical analysis (chart patterns, indicators) or fundamental analysis (economic news)?

- Start with a Small Live Account: Once you’re confident with your demo trading, open a small live account. Begin with micro or mini lots to minimize risk as you transition to real money. The psychological aspect of trading with real money is very different from demo trading.

Essential Tools for Forex Beginners

To navigate the currency markets effectively, you’ll need some basic tools:

- Trading Platform: Most commonly, this will be MetaTrader 4 (MT4) or MetaTrader 5 (MT5), provided by your broker. These platforms offer charting tools, indicators, and the ability to execute trades. Understanding MetaTrader 4 basics is a good skill to develop.

- Economic Calendar: This tool lists upcoming economic news releases and events that can impact currency prices. Staying aware of the economic calendar forex events is vital.

- Charting Tools: Essential for technical analysis, allowing you to visualize price movements and identify patterns.

- Forex News Sources: Reliable news outlets that provide real-time updates on global economic and political developments.

Tips for Success in Forex Trading

Beyond the technicalities, successful forex trading requires discipline and a strong mindset. Here are some key forex trading tips for beginners:

- Start Small, Scale Up: Don’t invest large sums initially. Gain experience and confidence before increasing your capital.

- Strict Risk Management: Always use stop-loss orders to limit potential losses on a trade. Never risk more than a small percentage of your account on any single trade. Forex risk management is non-negotiable.

- Keep a Trading Journal: Document every trade – why you entered, why you exited, your emotions, and the outcome. This helps you learn forex trading online from your successes and mistakes.

- Stay Informed, Not Overwhelmed: Keep abreast of major economic news, but avoid making impulsive decisions based on every headline.

- Manage Your Emotions: Fear and greed are common pitfalls. Stick to your strategy and avoid emotional trading.

- Continuous Learning: The forex market is dynamic. Keep learning, adapting, and refining your skills.

Conclusion: Your Forex Trading Journey Begins

Forex trading for beginners is a journey that demands dedication, education, and disciplined practice. While the allure of the currency markets is strong, understanding the mechanics, mastering risk management, and committing to continuous learning are the cornerstones of success. By following this forex trading guide and approaching the market with a well-thought-out plan, you can build a solid foundation for navigating the exciting world of foreign exchange. Remember, responsible trading is smart trading.

This is my fjrst time pay a quick visit at here and i am in fact impressed

to read everthing at single place. http://boyarka-inform.com/