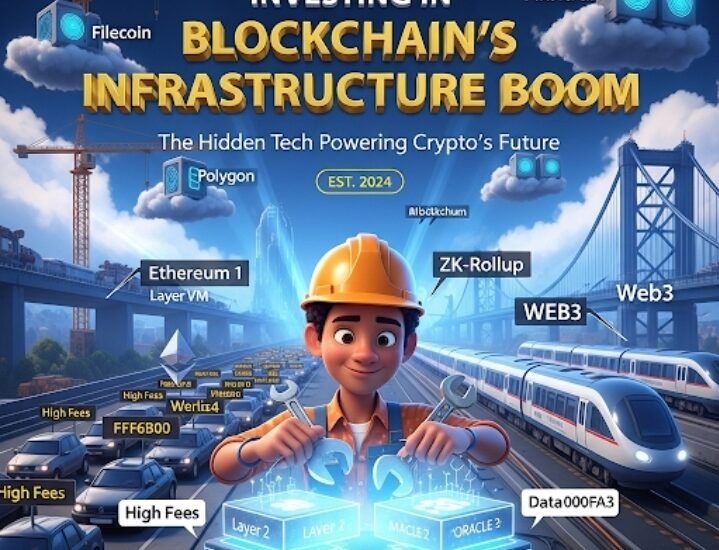

While much of the public’s attention in cryptocurrency gravitates towards soaring altcoins or groundbreaking NFTs, the true engine driving the decentralized revolution lies beneath the surface: blockchain infrastructure and Layer 2 scaling solutions. These foundational technologies are the unsung heroes, addressing the critical challenges of scalability, speed, and cost that are vital for mainstream adoption of Web3 and the broader digital economy.

For the savvy investor looking beyond speculative tokens, understanding and investing in these “building blocks of tomorrow” offers a unique opportunity to participate in the long-term growth of the decentralized internet. This article will deep dive into what these technologies are, why they are indispensable, and how you can identify promising blockchain infrastructure investment opportunities.

Understanding Blockchain Infrastructure: The Foundation of Decentralization

At its core, blockchain infrastructure refers to the underlying components and services that allow blockchain networks to operate securely, efficiently, and in a decentralized manner. Think of it as the roads, power grids, and communication networks for the digital world.

Key elements of this infrastructure include:

- Nodes & Validators: The decentralized computers that store, verify, and process transactions, ensuring the integrity and security of the network.

- Decentralized Storage: Solutions like Filecoin (FIL) and Arweave (AR) that provide robust, censorship-resistant data storage for dApps, moving beyond centralized cloud providers.

- Oracle Networks: Crucial bridges like Chainlink (LINK) that securely feed real-world data (e.g., asset prices, weather) onto blockchains, enabling smart contracts to interact with external information.

- Interoperability Protocols: Technologies that allow different blockchains to communicate and transfer assets seamlessly, breaking down “walled gardens” and fostering a more connected ecosystem.

- Security Protocols: The cryptographic and consensus mechanisms (like Proof-of-Stake) that underpin the network’s integrity.

Why it’s crucial: Robust infrastructure is non-negotiable for blockchain scalability. Without it, decentralized applications (dApps) would be slow, expensive, and insecure, hindering widespread adoption. Investing here means investing in the very backbone of Web3.

The Rise of Layer 2 Solutions: Solving Blockchain’s Scaling Puzzle

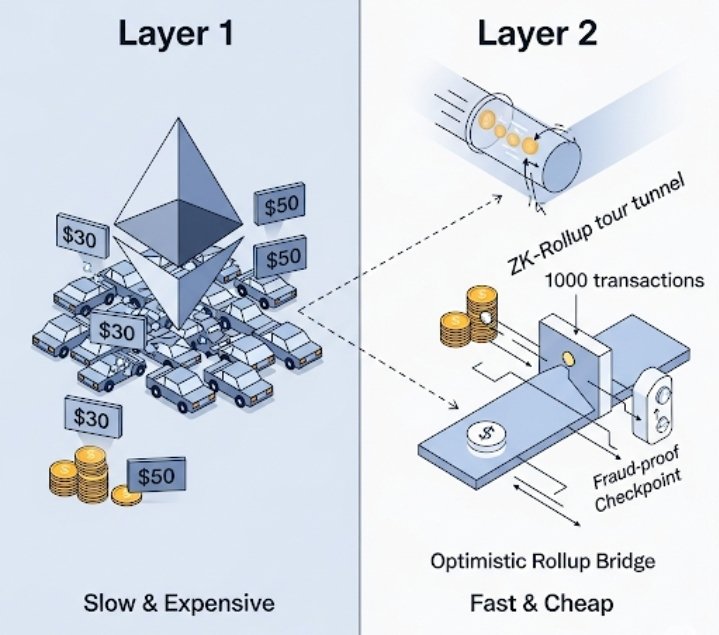

While foundational blockchains (Layer 1s) like Ethereum offer strong security and decentralization, they face limitations in processing high volumes of transactions quickly and cheaply. This is where Layer 2 scaling solutions come in.

- Why they are needed: Layer 1s often suffer from high transaction fees (gas fees) and network congestion during peak demand, making everyday dApp usage impractical for many. Layer 2s are designed to alleviate these issues.

- How they work: Layer 2s process transactions off-chain (off the main Layer 1 blockchain) and then periodically bundle or “batch” these transactions together, submitting a single, compressed proof of their validity back to the Layer 1. This significantly reduces the load on the main chain.

- Types of Layer 2s (with a focus on Rollups):

- Rollups (Optimistic & ZK-Rollups): These are currently the most dominant and promising Layer 2 solutions.

- Optimistic Rollups (e.g., Optimism, Arbitrum): Assume transactions are valid by default and provide a “challenge period” for anyone to dispute fraudulent transactions.

- ZK-Rollups (Zero-Knowledge Rollups) (e.g., zkSync, StarkNet, Polygon zkEVM): Use complex cryptographic proofs to instantly verify the validity of off-chain transactions, offering higher security guarantees and faster finality.

- Sidechains: Independent blockchains compatible with a Layer 1, often with their own consensus mechanisms (e.g., Polygon PoS chain, though newer Polygon solutions are ZK-Rollups).

- State Channels & Plasma: Earlier scaling attempts, less widely adopted now.

- Rollups (Optimistic & ZK-Rollups): These are currently the most dominant and promising Layer 2 solutions.

- Benefits: Lower transaction costs, faster transaction speeds, and a significantly enhanced user experience for dApp users, making blockchain applications more accessible and practical for mass adoption.

Investment Opportunities in Blockchain Infrastructure & Layer 2s

For investors seeking long-term growth and a stake in the foundational elements of Web3, investing in blockchain infrastructure and Layer 2s presents compelling opportunities:

Native Tokens of Leading Layer 2 Protocols:

- Polygon (MATIC): Known for its versatile scaling solutions, including its PoS sidechain and newer ZK-Rollup efforts (Polygon zkEVM).

- Arbitrum (ARB) & Optimism (OP): Leading Optimistic Rollups on Ethereum, boasting significant Total Value Locked (TVL) and dApp ecosystems.

- Emerging ZK-Rollup Tokens: As ZK-Rollups mature, tokens from projects like zkSync and StarkNet (when available) represent a high-potential, albeit higher-risk, frontier. These are key for blockchain scaling solutions investment.

Decentralized Storage Networks:

- Filecoin (FIL) & Arweave (AR): These projects are building the decentralized cloud storage layer for Web3, essential for hosting dApps, NFTs, and vast amounts of data securely and permanently.

Oracle Networks:

- Chainlink (LINK): As the industry standard for decentralized oracles, Chainlink’s role in securely connecting smart contracts to real-world data makes it an indispensable piece of infrastructure. Its CCIP (Cross-Chain Interoperability Protocol) is also vital for cross-chain communication.

Cross-Chain & Interoperability Solutions:

- Investing in protocols and tokens that facilitate seamless communication and asset transfers between disparate blockchains (e.g., Polkadot, Cosmos, Chainlink CCIP). As the blockchain landscape becomes multi-chain, interoperability becomes paramount.

Decentralized Physical Infrastructure Networks (DePIN):

- This is a burgeoning sector where blockchain incentivizes the build-out and maintenance of real-world physical infrastructure, from wireless networks (e.g., Helium) to energy grids and sensor networks. It’s a cutting-edge area for Web3 infrastructure investment.

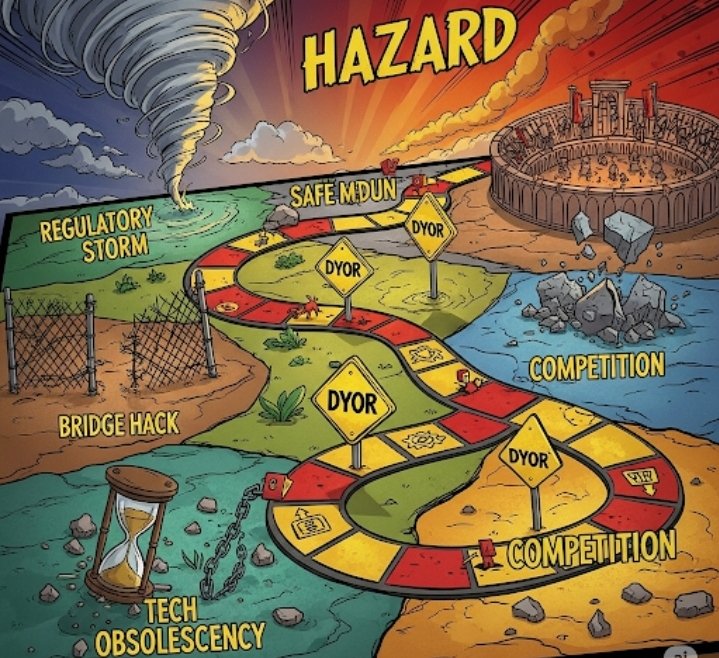

Key Investment Considerations & Risks

While promising, investing in these foundational technologies requires careful consideration:

- Technical Complexity: A basic understanding of how these technologies work is crucial. Read whitepapers and technical documentation.

- Competition: The Layer 2 and infrastructure space is highly competitive. Assess a project’s unique value proposition, technology, and ability to attract developers and users.

- Network Effects: Success often hinges on a project’s ability to attract and retain developers building dApps and users interacting with them. Analyze user growth and Total Value Locked (TVL).

- Interoperability Security: Cross-chain bridges, while essential, can be targets for exploits. Understand the security models of these solutions.

- Regulatory Scrutiny: As the backbone of the decentralized economy, these infrastructures may face increasing regulatory attention globally.

- Technological Obsolescence: The pace of innovation in blockchain is rapid. Ensure the technology is adaptable and future-proof.

The Future Outlook: Indispensable for Web3’s Expansion

Blockchain infrastructure and Layer 2 solutions are not just trends; they are indispensable components for the long-term success and mass adoption of decentralized technologies. As more users onboard into Web3, as dApps become more complex, and as enterprise and institutional blockchain adoption grows, the demand for scalable, efficient, and interconnected underlying layers will only intensify.

Investing in these blockchain scaling solutions and fundamental infrastructure projects means investing in the very fabric of the decentralized internet. They are the silent enablers of the next wave of innovation, poised to generate substantial value as the digital economy continues to expand.

Conclusion

The journey beyond Bitcoin leads directly to the foundational layers that make the entire crypto ecosystem possible. Investing in blockchain infrastructure and Layer 2 solutions offers a strategic pathway to participate in the inevitable growth of Web3. By understanding the critical role of these technologies in addressing scalability and interoperability, and by conducting thorough due diligence on promising projects, investors can position themselves at the heart of tomorrow’s digital economy. Remember to research diligently, diversify your portfolio, and prioritize security in this exciting and rapidly evolving space.