What Is BNB? Origins, Evolution, and Utility

BNB serves as the backbone of the Binance ecosystem, powering transactions across multiple chains

BNB (formerly known as Binance Coin) was launched in July 2017 through an Initial Coin Offering (ICO) that raised $15 million. Originally created as an ERC-20 token on the Ethereum blockchain, BNB was designed primarily to provide discounted trading fees on the Binance exchange. The name was later changed to “Build ‘N Build” to better reflect its expanded utility beyond the exchange.

Founded by Changpeng Zhao (commonly known as “CZ”) and Yi He, BNB was initially priced at just $0.11 during its ICO. By 2024, the token had experienced remarkable growth, with prices exceeding $600 – representing a return of over 500,000% for early investors.

The BNB Chain Ecosystem

Today, BNB operates across multiple interconnected blockchains that form the BNB Chain ecosystem:

- BNB Smart Chain (BSC): The primary chain that handles smart contracts and decentralized applications (dApps)

- opBNB: A layer-2 solution built for faster transactions and lower fees

- zkBNB: Another layer-2 scaling solution using zero-knowledge proofs for gaming and social applications

- BNB Greenfield: A decentralized storage solution focused on data ownership

BNB Token Standard and Technical Specifications

| Feature | Specification |

| Token Standard | BEP-20 (Binance Smart Chain) |

| Initial Supply | 200,000,000 BNB |

| Current Circulating Supply | ~141,000,000 BNB (as of 2024) |

| Target Final Supply | 100,000,000 BNB (after all burns) |

| Consensus Mechanism | Proof of Staked Authority (PoSA) |

| Block Time | ~3 seconds |

Key Use Cases for BNB

On Binance Exchange

- Pay trading fees with a discount

- Participate in token sales on Binance Launchpad

- Collateral for crypto loans

- Gift card purchases

On BNB Chain

- Pay transaction fees (gas)

- Stake for network security and rewards

- Participate in governance voting

- Create and interact with dApps

Start Trading BNB Today

Join millions of investors who trust Binance for secure and efficient BNB trading with industry-leading liquidity.

BNB Auto-Burn: How It Works & Economic Impact

One of BNB’s most distinctive features is its auto-burn mechanism – a deflationary model designed to systematically reduce the total supply of BNB tokens over time. This process helps maintain scarcity and potentially supports long-term value appreciation.

Evolution of BNB’s Burning Mechanism

BNB’s token burning strategy has evolved significantly since its inception:

- Initial Quarterly Burns (2017-2021): Binance committed to using 20% of its profits to buy back and burn BNB quarterly until 50% of the total supply (100 million tokens) was removed from circulation.

- Auto-Burn Introduction (December 2021): Replaced the quarterly burn with an automated process that doesn’t rely on Binance’s profits, making the system more transparent and predictable.

How the Auto-Burn Mechanism Works

The BNB Auto-Burn follows a formula-based approach rather than being tied to Binance’s profits:

The number of BNB to be burned is calculated based on:

- The total number of blocks produced on the BNB Smart Chain during the quarter

- The average BNB price during the same period

This creates a predictable, transparent burning schedule that continues until the circulation reaches 100 million BNB.

Recent Quarterly Burn Examples

| Quarter | BNB Burned | USD Value | Remaining Supply |

| Q4 2023 | 2,201,037 | $683 million | 142,953,121 |

| Q1 2024 | 1,863,432 | $595 million | 141,089,689 |

| Q2 2024 | 2,014,856 | $712 million | 139,074,833 |

Economic Impact of BNB Burns

Supply-Side Effects

- Continuous reduction in circulating supply

- Increased scarcity over time

- Counterbalance to inflationary pressures

Market Effects

- Potential price support during market downturns

- Increased investor confidence in long-term tokenomics

- Reduced selling pressure from excess supply

“The BNB Auto-Burn effectively removes the human element from the equation, creating a more predictable deflationary schedule that doesn’t depend on Binance’s profitability. This transparency benefits both the ecosystem and token holders.”

Track BNB Burns in Real-Time

Stay updated on the latest BNB burn events and analyze their impact on token supply with our interactive dashboard.

BNB Price Analysis 2025-2030

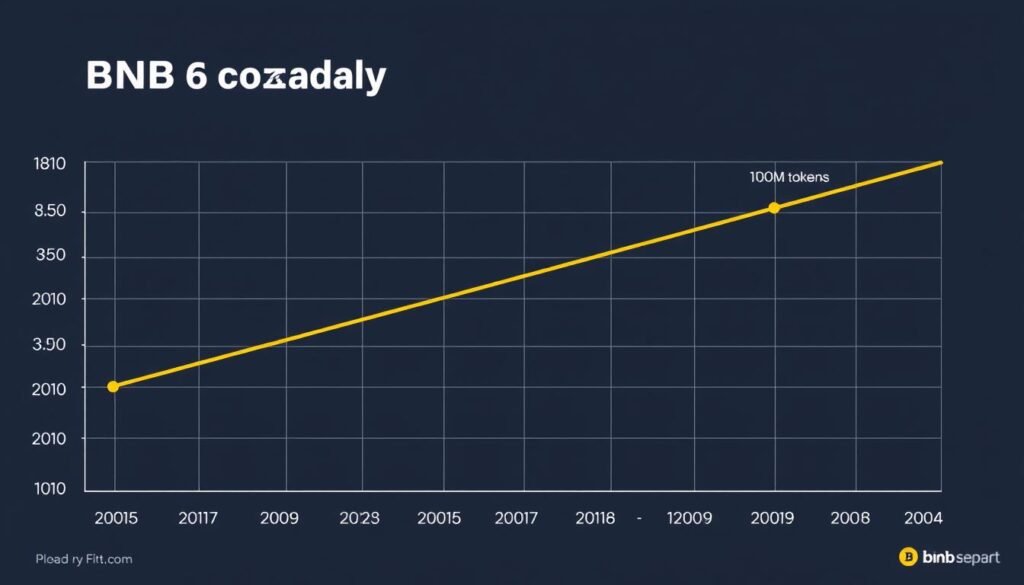

BNB Price Projection 2025-2030

Hypothetical projection based on market cap growth and burn rate models. Not financial advice.

Predicting cryptocurrency prices is inherently challenging due to market volatility, regulatory changes, and technological developments. However, by analyzing BNB’s fundamentals, burn rate, and ecosystem growth, we can explore potential price trajectories for 2025-2030.

Key Factors Influencing BNB’s Future Price

Supply Dynamics

- Continued token burns reducing supply

- Approaching the 100M token target

- Staking and locked tokens reducing circulating supply

Ecosystem Growth

- BNB Chain adoption and transaction volume

- DeFi and dApp development

- Layer-2 solutions and scaling improvements

External Factors

- Regulatory developments worldwide

- Broader crypto market cycles

- Institutional adoption trends

Year-by-Year Price Projections

| Year | Conservative Estimate | Moderate Estimate | Optimistic Estimate | Key Drivers |

| 2025 | $800 | $1,200 | $1,800 | Continued burns, BSC adoption |

| 2026 | $950 | $1,500 | $2,300 | Layer-2 scaling, DeFi growth |

| 2027 | $1,100 | $1,900 | $3,200 | Supply approaching 120M tokens |

| 2028 | $1,400 | $2,400 | $4,100 | Institutional adoption, regulatory clarity |

| 2029 | $1,800 | $3,200 | $5,500 | Supply approaching 110M tokens |

| 2030 | $2,300 | $4,000 | $7,000 | Supply nearing final 100M target |

Note: These projections are speculative and based on current trends and assumptions. Cryptocurrency markets are highly volatile, and actual prices may vary significantly from these estimates. Always conduct your own research before making investment decisions.

Expert Opinions on BNB’s Future

“BNB’s combination of utility across multiple chains, deflationary tokenomics through the auto-burn mechanism, and strong ecosystem growth positions it well for long-term value appreciation. The systematic reduction in supply creates a fundamental scarcity that few other major cryptocurrencies can match.”

“While BNB faces regulatory challenges in some markets, its technical fundamentals remain strong. The token’s diverse utility across trading, staking, and powering dApps creates multiple demand drivers that should support price growth as the supply continues to decrease.”

Stay Updated on BNB Price Movements

Get real-time alerts and expert analysis on BNB price trends delivered straight to your inbox.

Future of BNB: Ecosystem Growth & Regulatory Outlook

The future of BNB extends far beyond its role as a utility token for the Binance exchange. As the backbone of an expanding multi-chain ecosystem, BNB is positioned at the center of numerous growth initiatives while navigating an evolving regulatory landscape.

BNB Chain Development Roadmap

The BNB Chain ecosystem continues to evolve with several key initiatives planned for the coming years:

- BNB Chain Fusion: Consolidating chain functionalities to improve efficiency and user experience

- Scaling Solutions: Enhancing opBNB and zkBNB to achieve 10,000+ transactions per second

- Cross-Chain Interoperability: Improving bridges between BNB Chain and other major blockchains

- Developer Tools: Expanding resources for building on BNB Chain to attract more dApps

- Security Enhancements: Building on AvengerDAO’s work to reduce hacking and scams

Growing Use Cases for BNB

DeFi Expansion

- Lending and borrowing platforms

- Yield farming opportunities

- Decentralized exchanges

- Automated market makers

Web3 Integration

- NFT marketplaces and collections

- GameFi and play-to-earn models

- Metaverse applications

- Digital identity solutions

Enterprise Solutions

- Supply chain tracking

- Cross-border payments

- Tokenized real-world assets

- Corporate treasury diversification

Regulatory Challenges and Adaptation

The regulatory environment for cryptocurrencies continues to evolve globally, with implications for BNB and the broader Binance ecosystem:

Positive Developments

- Increasing regulatory clarity in major markets

- Binance’s efforts to obtain licenses in various jurisdictions

- Growing institutional acceptance of regulated crypto assets

- Development of compliance-focused features and tools

Ongoing Challenges

- Varying regulatory approaches across different countries

- Potential classification as a security in some jurisdictions

- Compliance requirements for centralized exchanges

- Balancing innovation with regulatory requirements

BNB Staking and Governance Evolution

The role of BNB in network governance and staking is expected to expand:

- Enhanced Staking Mechanisms: More flexible staking options with competitive yields

- Governance Expansion: Greater community involvement in ecosystem decisions

- Validator Improvements: More decentralized validator selection and operation

- Delegation Options: Easier ways for token holders to participate in network security

“The future of BNB lies in its ability to balance centralized efficiency with decentralized innovation. As the ecosystem continues to expand beyond Binance’s direct control, BNB’s utility and governance role will likely evolve to support a more community-driven approach while maintaining the performance advantages that have made it successful.”

Start Building on BNB Chain

Access developer resources, funding opportunities, and community support to bring your blockchain project to life on BNB Chain.

Frequently Asked Questions About BNB

Is BNB a good investment?

BNB has several characteristics that make it attractive to investors, including its deflationary tokenomics through the auto-burn mechanism, utility across multiple platforms, and central role in the growing BNB Chain ecosystem. However, like all cryptocurrencies, BNB involves significant risks including price volatility, regulatory uncertainty, and technological challenges.

Whether BNB is a good investment depends on your risk tolerance, investment timeline, and portfolio diversification strategy. Consider consulting with a financial advisor before making significant cryptocurrency investments.

How does the auto-burn increase BNB value?

The auto-burn mechanism systematically reduces BNB’s total supply over time, creating increasing scarcity. According to basic economic principles, if demand remains constant or increases while supply decreases, price tends to rise. By burning tokens quarterly based on a transparent formula, BNB implements a predictable deflationary model that potentially supports long-term value appreciation.

However, it’s important to note that many factors beyond supply reduction affect cryptocurrency prices, including market sentiment, utility, competition, and regulatory developments.

What is the difference between BNB and BEP-20 tokens?

BNB is the native cryptocurrency of the BNB Chain ecosystem, while BEP-20 is a token standard on the BNB Smart Chain (similar to ERC-20 on Ethereum). BNB itself follows the BEP-20 standard when used on the BNB Smart Chain, but it has special status as the network’s native asset.

Other projects can create their own BEP-20 tokens on BNB Smart Chain, but these tokens require BNB to pay for transaction fees when transferring them. Think of BNB as the primary currency of the ecosystem, while BEP-20 tokens are additional assets that operate within it.

How many BNB tokens will be left after all burns?

According to Binance’s stated plans, the auto-burn mechanism will continue until the total supply reaches 100 million BNB. The original supply was 200 million tokens, meaning that ultimately 50% of all BNB will be permanently removed from circulation.

As of 2024, approximately 141 million BNB remain in circulation, with burns continuing quarterly. At current burn rates, it may take several more years to reach the final target of 100 million tokens.

Can I stake BNB for passive income?

Yes, BNB can be staked through various methods to earn passive income:

- Binance Earn: Stake directly on the Binance platform for flexible or locked staking options

- BNB Chain Staking: Become a validator (requires 10,000 BNB minimum) or delegate your BNB to existing validators

- DeFi Platforms: Use BNB in various yield farming and liquidity provision strategies on decentralized platforms

Staking rewards vary based on the method chosen, market conditions, and the amount staked. Always research the security and reputation of any platform before staking your assets.

Conclusion: BNB’s Position in the Evolving Crypto Landscape

BNB has transformed from a simple exchange token into a multi-faceted cryptocurrency that powers one of the largest blockchain ecosystems in the world. Its unique auto-burn mechanism creates a deflationary model that distinguishes it from many other major cryptocurrencies, potentially supporting long-term value through systematic supply reduction.

As the BNB Chain ecosystem continues to expand with layer-2 solutions, DeFi applications, and enterprise integrations, BNB’s utility extends far beyond its original purpose. The token now serves as the backbone for a diverse range of blockchain activities, from simple transactions to complex smart contract interactions.

Looking ahead to 2025-2030, BNB faces both significant opportunities and challenges. The continued execution of the auto-burn mechanism, ecosystem growth, and adaptation to evolving regulations will all play crucial roles in determining BNB’s future trajectory. While price predictions remain speculative, the fundamental utility and deflationary design of BNB position it as a cryptocurrency with distinctive characteristics in an increasingly crowded market.

For investors and users alike, understanding BNB’s unique features, use cases, and ecosystem dynamics provides valuable context for evaluating its potential role in portfolios and blockchain applications. As with any cryptocurrency investment, thorough research, risk assessment, and diversification remain essential practices.

Join the BNB Community

Connect with other BNB enthusiasts, developers, and investors to stay informed about the latest developments and opportunities.