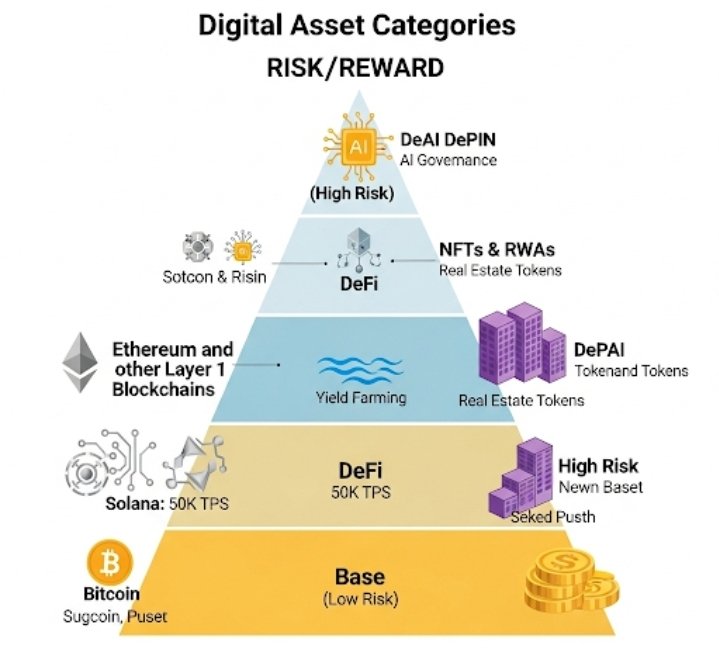

For numerous, the world of cryptocurrency begins and ends with Bitcoin. As the undisputed colonist, Bitcoin has indeed laid the foundation for the entire digital asset revolution. Still, the blockchain ecosystem has evolved far beyond its birth, giving rise to an incredible array of digital means offering unique functionalities, disruptive eventuality, and, crucially, high-growth investment openings that extend well beyond the original cryptocurrency. Still, understanding these arising sectors is essential. If you are looking to diversify your crypto portfolio and valve into the coming surge of invention, this composition will guide you through the instigative geography of digital asset investment that exists “beyond Bitcoin,” pressing crucial orders and smart investment strategies for the sapient investor.

Why Look Beyond Bitcoin? The Case for Digital Asset Diversification

While Bitcoin remains a robust store of value and a foundational asset, its growth line, while significant, may not always match the explosive eventuality of newer, more nimble systems. The digital asset request thrives on invention, with new blockchain technologies continually addressing scalability, mileage, and real-world integration. Exploring these arising digital means offers several advantages: Advanced Growth Implicit – lower, less mature systems frequently have further room for exponential growth if they gain relinquishment and break real-world problems. Diversification – Spreading your investments across different blockchain technology sectors reduces overall portfolio threat, mollifying volatility essential in any single asset. Exposure to Innovation – Invest in systems that are erecting the future of finance, gaming, force chains, and more, using the power of decentralized networks. Specific Use Cases – numerous altcoins and commemoratives offer direct exposure to specific decentralized operations (dApps) or assiduity results, allowing targeted investment.

High-Growth Digital Asset Orders to Watch in 2025 and Beyond

The digital asset geography is dynamic, with new narratives and technological advancements arising constantly. Then are some of the most promising areas for high-growth digital asset investment:

1. The Hustler Altcoins: Layer 1 & Subcaste 2 Ecosystems

While Bitcoin is a Subcaste 1 blockchain, numerous other foundational blockchains (Subcaste 1s) are erecting robust ecosystems with different dApps, addressing specific requirements. Subcaste 2 results, erected on top of Layer 1s, concentrate on scalability and effectiveness. Investing in these foundational commemoratives provides exposure to entire networks poised for significant relinquishment.

Ethereum (ETH) – Still the dominant smart contract platform, Ethereum continues to evolve, with its expansive DeFi investment openings and burgeoning NFT ecosystem making it a foundation of digital means. Recent rebounds in Ethereum ETPs signal renewed institutional interest.

Scalable Subcaste 1s – Systems like Solana (SOL) and Avalanche (AVAX) offer high sale pets and low freights, attracting inventors and druggies for colorful operations, from DeFi to gaming and RWA tokenization. Solana, in particular, is fleetly expanding its RWA request share.

Subcaste 2 results – Networks such as Polygon (MATIC), Arbitrum (ARB), and Sanguinity (OP) enhance the scalability of Ethereum and other Layer 1s by recycling deals off-chain, making dApps briskly and cheaper to use. Investing in these commemoratives provides exposure to the growing demand for effective blockchain deals.

2. Decentralized Finance (DeFi): Reshaping Financial Services

DeFi aims to recreate traditional fiscal systems using blockchain technology, removing interposers like banks. It’s a vast ecosystem offering lending, borrowing, trading, and insurance. The maturity, enhanced scalability, and adding interoperability of DeFi protocols present significant digital frugality investment eventuality.

Lending & Borrowing Protocols – Platforms like Aave or Emulsion allow druggies to advance crypto for interest or adopt against their effects.

Decentralized Exchanges (DEXs) – Uniswap and Wind Finance enable peer-to-peer crypto trading without centralized custodians.

Yield Husbandry & Staking – Share in securing networks or furnishing liquidity to earn unresistant income, a popular strategy for crypto portfolio diversification.

Stablecoins – Decreasingly used as a savings and payments instrument, especially in arising requests, bypassing traditional fiscal constraints. Their integration with regulated, yield-generating means like tokenized coffers is a crucial development.

3. The Elaboration of NFTs: Utility, Gaming & Beyond

Originally known for digital art and collectibles, Non-Fungible Commemoratives (NFTs) are fleetly expanding into areas with palpable mileage. The NFT mileage beyond art narrative is a crucial blockchain investment trend 2025.

Gaming & Metaverse Means – In-game particulars, virtual land, and character skins within blockchain games are getting precious metaverse investment openings. Play-to-earn (P2E) models are driving new profitable models and attracting substantial stoner bases.

Digital Identity & Enrollments – NFTs can serve as empirical digital individualities, access passes to exclusive communities, or tickets for events, offering empirical power and unique stoner gests.

Tokenized Real Estate & Intellectual Property – Fractional power of physical means or royalties from creative workshop can be represented by NFTs, offering new avenues for accessible and liquid investment.

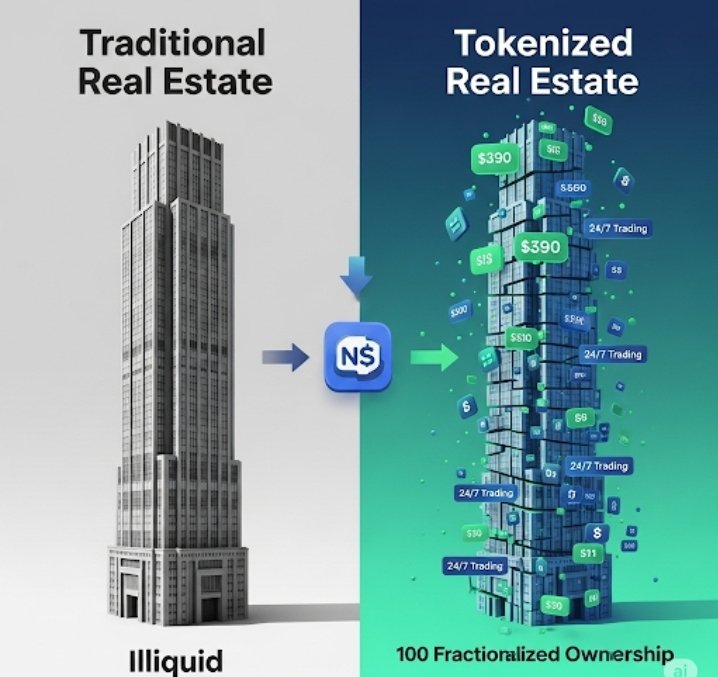

4. Real-World Asset (RWA) Tokenization: Bridging Traditional and Digital Finance

One of the most transformative blockchain invention investing areas is the tokenization of real-world means. This involves representing palpable means like real estate, bonds, equities, goods, or indeed art as digital commemoratives on a blockchain. The RWA request surged to over $25 billion in Q2 2025, driven by institutional demand.

Increased Liquidity – Tokenization allows for fractional power, making traditionally illiquid means more accessible to a broader range of investors.

Enhanced Translucency – Power records are inflexible and empirical on the blockchain, reducing fraud and adding trust.

Global Access – Investors worldwide can share in openings preliminarily confined by geographical or nonsupervisory walls.

Institutional Relinquishment – Major fiscal institutions are decreasingly treating tokenization as public fiscal structure, with a new surge of tokenized stocks arising on leading digital trading platforms. Investing in platforms easing real-world asset tokenization investment could offer substantial long-term earnings as this sector matures.

5. Arising Borders: DePIN and DeAI

Looking further into slice-edge blockchain technology investment areas, Decentralized Physical Structure Networks (DePINs) and Decentralized Artificial Intelligence (DeAI) are gaining significant traction.

DePINs – Systems erecting decentralized networks for physical structure, similar as wireless networks, energy grids, or detector networks. These influence blockchain to incentivize participation and produce more flexible, community-owned structure, addressing real-world functional requirements.

DeAI – Integrating AI with blockchain to produce more transparent, secure, and suppression-resistant AI models and operations, moving down from centralized control over AI development and fostering a new paradigm for AI-powered crypto systems.

Smart Investment Strategies for High-Growth Digital Means

Investing in digital means beyond Bitcoin comes with advanced implicit prices, but also advanced pitfalls due to increased volatility and less established requests. Prudent strategies are pivotal for navigating this geography:

Deep Dive Due Industriousness (DYOR) – This cannot be stressed enough. Research the design’s whitepaper, platoon, technology, use case, tokenomics (how the commemorative is distributed and used), and community. Understand the problem it solves, its competitive geography, and its long-term viability. Do not invest grounded on hype or social media trends alone.

Diversification Is Crucial – Noway put all your capital into a single altcoin or arising sector. Spread your crypto portfolio diversification across colorful high-implicit means and orders to alleviate threat and prisoner growth from different areas.

Risk Management & Volatility Mindfulness – Digital means are largely unpredictable. Only invest capital you can go to lose. Consider setting stop-loss orders and regularly rebalancing your portfolio to manage exposure. Understand that crypto request volatility operation is a nonstop process.

Long-Term Vision (HODLing with Conviction) – Numerous high-growth openings bear tolerance. Short-term price swings can be significant, but abecedarian strength and ecosystem growth frequently award long-term holders.

Security First – Use a tackle portmanteau (cold storehouse) for significant effects, as it keeps your private keys offline. Always enable Two-Factor Authentication (2FA) on exchanges and hot holdalls. Utmost critically, guard your seed expression on paper – noway store it digitally, as this is the master key to your finances.

Start Small and Learn – For newcomers, allocate a small, manageable chance of your investment capital to these advanced-threat, advanced-price openings. Gradationally increase your exposure as your understanding and confidence grow.

Cover the Regulatory Landscape – The digital asset security and nonsupervisory terrain is constantly evolving encyclopedically. Stay informed about developments that could impact your investments, as nonsupervisory clarity frequently leads to increased institutional relinquishment.

The Road Ahead: Navigating the Future of Digital Asset Investment

The digital asset space is still in its incipient stages, but its eventuality is inarguable. As blockchain invention continues to push boundaries, driven by real-world mileage, adding institutional relinquishment, and nonstop technological advancements, the openings beyond Bitcoin will only multiply. The shift towards regulated investment vehicles like digital asset ETPs also signals a development of the request, making it more accessible to a broader range of investors.

Conclusion

While Bitcoin correctly holds its place as the bedrock of the crypto request, the world of high-growth digital asset investment is vast and instigative. From foundational altcoins powering decentralized operations to revolutionary RWA tokenization, the evolving DeFi geography, and the burgeoning metaverse, new openings are constantly arising. By combining thorough digital asset investment strategies with active crypto request volatility operation and a commitment to nonstop literacy, investors can confidently explore these borders and place themselves for significant growth in the evolving digital frugality. Flash back: research diligently, diversify wisely, prioritize security, and only invest what you’re comfortable losing.