The traditional fiscal world, with its layers of interposers and frequently opaque processes, is being unnaturally challenged by Decentralized Finance (DeFi). Erected on blockchain technology, DeFi aims to recreate a global, open, and permissionless fiscal system where druggies have direct control over their means. For numerous, DeFi represents a revolutionary occasion not just to manage plutocrat else, but to laboriously induce unresistant income and engage in sophisticated fiscal strategies preliminarily reserved for institutional players.

This composition offers a DeFi deep dive, exploring how you can unleash colorful aqueducts of unresistant income and claw into advanced DeFi strategies that are shaping the future of finance. We will also cover pivotal threat operation tips to help you navigate this instigative, yet complex, geography.

The DeFi Revolution: A New Paradigm for Passive Income

At its core, DeFi leverages smart contracts – tone-executing agreements on the blockchain – to automate fiscal services. This eliminates the need for banks, brokers, and other third parties, leading to lesser translucency, effectiveness, and availability. For the average existent, this translates into unknown openings to earn:

- Advanced Yields – frequently significantly better than traditional savings accounts.

- Access requests noway near, allowing constant engagement.

- Permissionless Participation – Anyone with an internet connection and crypto can share.

The pledge of DeFi unresistant income has attracted millions, making it a foundation of the digital frugality.

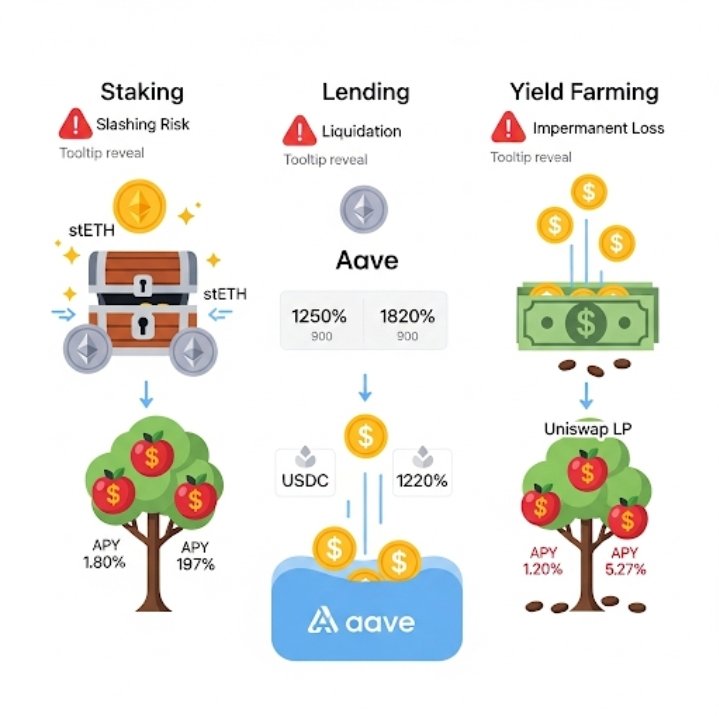

1. Staking: Earning Prices for Securing Networks

Staking is maybe the most straightforward way to earn unresistant income in DeFi. It involves locking up your cryptocurrency to support the operations of a blockchain network, generally one using a evidence-of-Stake (PoS) agreement medium. In return for contributing to network security and validating deals, you admit recently formed commemoratives as prices.

- How it Works – You “stake” your commemoratives (e.g., Ethereum’s ETH on Subcaste 1) into a staking pool or directly on a validator knot. The network also uses your staked commemoratives to corroborate deals.

- Liquid Staking – This advanced form allows you to admit a “liquid staking outgrowth” commemorative (e.g., stETH for staked ETH) which can also be used in other DeFi protocols (like lending) while your original ETH remains staked, effectively earning double yield.

- Considerations – Choose estimable staking platforms or validators. Understand the unbonding period (time it takes to unstake your commemoratives).

2. Lending & Borrowing: Getting Your Own Bank

DeFi advancing platforms connect borrowers directly with lenders through automated smart contracts. Lenders supply liquidity to pools, earning interest from borrowers who take out over-collateralized loans.

- How it Works – You deposit crypto (e.g., USDC, ETH) into a lending pool on platforms like Aave or Emulsion. Borrowers can also draw from this pool by putting up more contributory than they adopt (e.g., adopting $100 with $150 worth of ETH collateral).

- Interest Rates – These are dynamic, shifting grounded on force and demand within the protocol.

- Pitfalls – While over-collateralization protects lenders, borrowers face liquidation threat if their collateral’s value drops too important.

3. Yield Husbandry (Liquidity Mining): Maximizing Returns

Yield husbandry is a more advanced strategy that involves moving your crypto means between different DeFi protocols to maximize returns. It frequently involves furnishing liquidity to decentralized exchanges (DEXs) or advancing protocols to earn colorful commemoratives as prices.

- How it Works – You come a Liquidity Provider (LP) by depositing two different commemoratives into a Decentralized Exchange (DEX)’s liquidity pool (e.g., ETH and USDC on Uniswap). In return, you admit LP commemoratives, which represent your share of the pool. These LP commemoratives can also be “farmed” (staked) in other protocols to earn fresh governance commemoratives or other prices.

- LP Commemoratives – These commemoratives accrue trading freights from deals eased by the pool.

- Pitfalls – Impermanent loss is a significant threat unique to liquidity furnishing.

Advanced DeFi Strategies for Maximized Returns

Once you grasp the basics, advanced DeFi strategies can amplify returns, but they also come with significantly advanced complexity and threat. These are generally not for newcomers.

- Leveraged Yield Husbandry

- Amplified Returns – Implicit for significantly advanced gains.

- Amplified Pitfalls – Liquidation threat is largely increased due to espoused finances.

- Arbitrage

- How it Works – Buy low on one exchange, vend high on another.

- Requires Speed & Capital – Frequently executed by bots, taking lightning-fast deals.

- Flash Loans

- Purpose – Primarily used by inventors and educated dealers.

- Extremely High Risk/Complexity – Not for individual investors.

- DeFi Options & Derivations

- Purpose – Managing threat, assuming on volatility, or creating synthetic means.

- Complex – Requires deep understanding of options pricing.

- Structured Products

- Simplifies Complexity – Automates colorful DeFi relations.

- Underlying Pitfalls Remain – Still subject to smart contract threat, impermanent loss, etc.

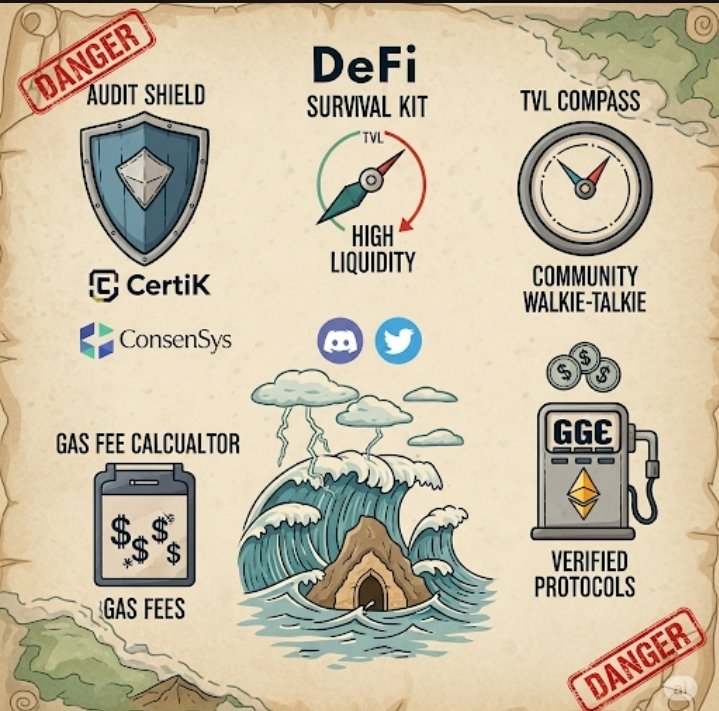

Crucial Considerations & Pitfalls in DeFi

While the openings are vast, DeFi isn’t without its threats. Understanding and mollifying these pitfalls is consummate for secure crypto investment.

- Smart Contract Threat – Protocol code can have bugs or vulnerabilities.

- Impermanent Loss – Can lead to a lower value than holding assets directly.

- Liquidation Threat – Borrowers’ collateral can be auto-sold.

- Hairpiece Pulls – Exit swindles where inventors abandon a design.

- Regulatory Query – Changes in regulation may affect viability.

- Gas Freights & Network Traffic – High costs during congestion.

- Oracle Failure – Can lead to mispricing and manipulation.

Choosing the Right DeFi Protocols & Due Industriousness

Before diving into any DeFi protocol or strategy, rigorous Decentralized Finance exploration (DYOR) is critical:

- Security Checkups – Look for multiple audits from reputable firms.

- Total Value Locked (TVL) – Indicates trust and liquidity.

- Community & Team – Transparency and engagement are good signs.

- Attestation – Clear, professional documentation.

- Track Record – Consider the protocol’s operational history.

The Future of DeFi: Institutional Adoption and Beyond

The future of DeFi is poised for massive expansion. As the technology matures and nonsupervisory fabrics begin to take shape, we’re seeing adding institutional interest. This includes:

- Tokenization of Real-World Means (RWA) – Bridging TradFi with DeFi.

- Scalability Results and Cross-Chain Interoperability – A more connected ecosystem.

- Sophisticated DeFi Investment Openings – With clearer risk profiles for broader appeal.

Conclusion

Decentralized Finance offers a powerful new frontier for generating unresistant income and executing advanced investment strategies. From staking and advancing to yield husbandry and more complex leveraged positions, the openings are vast and continue to grow. Still, the decentralized nature means particular responsibility is consummate. By understanding the core mechanics, conducting thorough exploration, and diligently managing the essential pitfalls, you can confidently explore the deep waters of DeFi and unleash its transformative eventuality for your digital asset portfolio. Always flash back: start small, learn continuously, and prioritize security.